Top Takeaways from LinkedIn’s New ‘Enlightened Tech Buyer’ Report

Technology is one of the fastest-growing B2B sectors, for reasons that are self-evident. As new solutions and innovations continue to enhance the way businesses operate across every industry, every key department has increasing tech needs and buying power these days.

The folks at LinkedIn* recently released a 2019 global report, The Enlightened Tech Buyer: Powering Customer Decisions from Acquisition to Renewal, and it merits attention from marketers of all stripes. As the “enlightened” descriptor implies, tech buyers (for reasons that are also self-evident) tend to be ahead of the curve when it comes to research, consumption, and purchase behaviors.

Today we’ll take a deeper look at LinkedIn’s new data around this trendsetting cohort, breaking down five key revelations within.

5 Telling Trends Revealed in LinkedIn’s Tech Buyer Report

Here are some of the most eye-opening tidbits we saw based on LinkedIn’s survey of “5,241 global professionals who participated in or influenced the purchase of various hardware or software solutions at their organization within the last three months.”

#1 – Tech Buying Committees are Expansive and Diverse

We all know that, in general, B2B buying committees are expanding faster than the Night King’s army of wights. This dynamic is especially pronounced in the tech space.

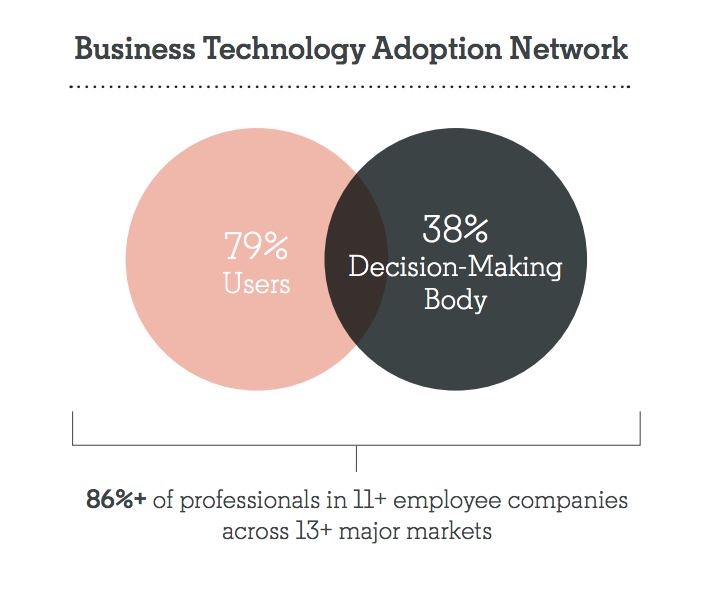

“Where previously 3/4 of enterprise employees were part of technology decision-making,” LinkedIn reports, “today the total universe of end-users and decision-makers who impact business technology investments encompasses 4/5 of employees (roughly 86%).”

As tech products and services become increasingly integrated with every aspect of an organization, more voices are coming into play. End users, external influencers, and cross-functional stakeholders all tend to have a role. This reinforces the imperative of establishing strong brand awareness throughout a business, which is a central focus of account-based marketing.

#2 – The Purchase Cycle is Shortening

The report notes that the process of reviewing, selecting, and implementing new tech solutions has accelerated over the past few years, with the average purchase cycle now checking in at about 25 months. This could be viewed as good news or bad news, depending on how you look at it.

On the one hand, that’s still a fairly long timespan, providing plenty of opportunity for marketing content to make an impact. Meanwhile, the increase in velocity could suggest buyers are becoming more deliberate and urgent in identifying solutions.

But on the other hand, this also means that we as marketers have a smaller window than before to engage and persuade. We now need to make each interaction count more than ever — especially if we’re pursuing a new account. LinkedIn’s study shows that shortlists are becoming more competitive than ever for vendors.

#3 – Vendor Websites Are a Prime Resource

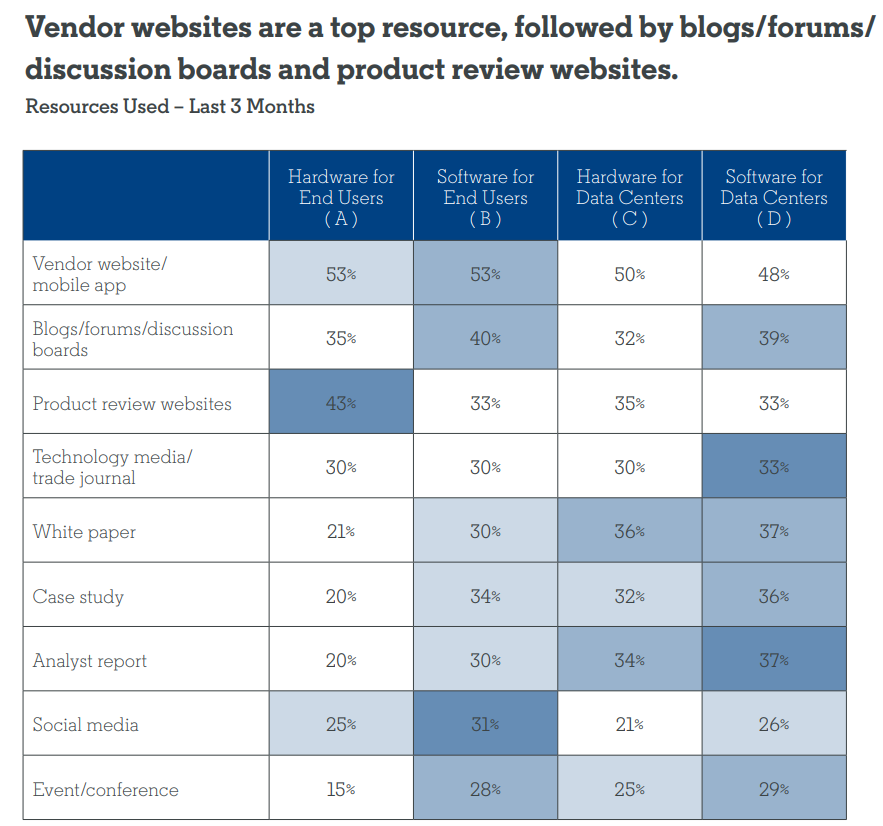

Across every B2B tech category, vendor website/mobile app is the top research destination for buyers. In aggregate, this source is followed by blogs/forums/discussion boards, product review websites, and technology media/trade journals:

In short, buyers are seeking out trustworthy information — be it from a company’s own website or from unbiased third party resources. This accentuates the importance of building credibility with best-answer content, which can satisfy a decision maker’s questions during research while also positioning your brand as helpful and knowledgeable.

#4 – Buyers Want Partners, Not Sellers

Above all, tech buyers value the overall quality of a product or service above all when choosing a vendor. (Duh.) But the next two factors are interesting: both the ability to consistently meet a buyer’s needs, and the ability to answer questions to a buyer’s satisfaction, rank above affordability/pricing in importance:

This is why the customer experience is becoming such an overarching imperative. Effective marketing now goes beyond the scope of traditional functions. Brands need to be readily available, with the right content at the right time. Strategies must account for every touch point. Always-on approaches are becoming the norm. And this level of attentiveness should go beyond the actual purchase itself…

#5 – Smooth Implementation is Essential

Per LinkedIn, “The #1 indicator of customer renewal success is successful adoption and product satisfaction.” No surprise there. But it’s another reminder of why the full customer experience needs to be addressed.

“The data shows direct vendor engagement among buyers dropping off in later stages of purchase, meaning that there’s an opportunity to be more present and engaged with customers post-sale,” according to the report. “Marketers need to play an active role in the implementation and adoption process of new technology. A seamless customer experience also demands alignment with customer support in activities, training and key education resources.”

How can marketing continue to shape experiences in these later stages and after the sale? It’s a vital consideration for profitability, since we all know the relative cost of acquiring new customers compared to retaining existing ones.

Follow the Tech Buyers

None of the nuggets revealed in LinkedIn’s “Enlightened Tech Buyer” report are especially surprising, but they do reinforce some of the trends we see playing out at large:

- Buying committees are becoming more distributed

- Researchers seek out objective information and best-answer content

- We need to help, not sell

- Marketing is starting to impact more parts of the customer experience

To get the full scoop on today’s B2B tech buyer preferences, check out LinkedIn’s report.

*Disclosure: LinkedIn is a TopRank Marketing client.

The post Top Takeaways from LinkedIn’s New ‘Enlightened Tech Buyer’ Report appeared first on Online Marketing Blog – TopRank®.